Do you need more information?

Please, contact your account manager. They can help you take your Microsoft Business Solution to the next level.

Who is Paystand?

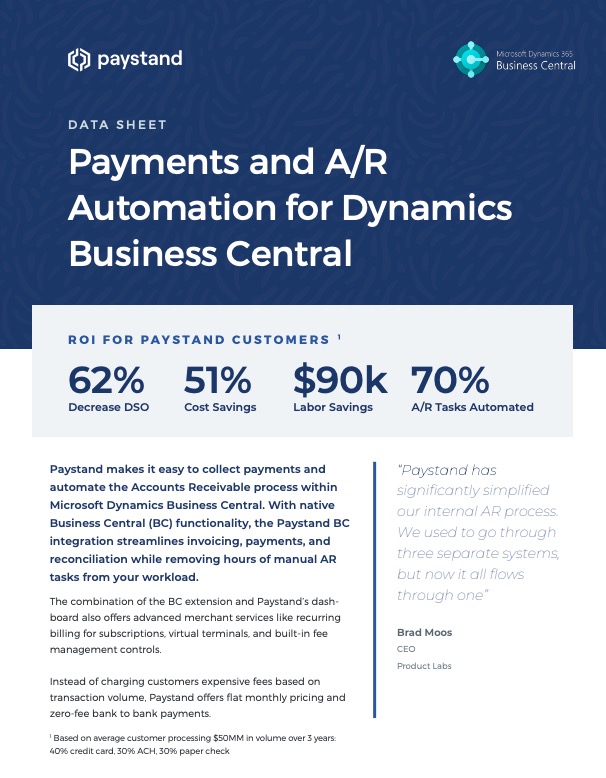

Paystand’s B2B payment solution deletes transaction fees, automates your accounts receivable reconciliation process, and speeds up your cash flow.

Revolutionize Your Payments with Microsoft Business Central and Paystand

Embark on a Journey to Zero

Businesses today need more than just a traditional ERP system; they require a seamless, automated, and cost-efficient payment solution that integrates directly with their financial workflows. Microsoft Dynamics 365 Business Central is a powerful ERP solution, but when paired with Paystand’s no-fee, automated B2B payments network, it transforms the way businesses manage accounts receivable.

With our cutting-edge integration, you can automate manual processes, reduce transaction costs, and enhance cash flow. All while keeping payments secure and compliant.

Microsoft Dynamics 365 Business Central’s Key Features

Microsoft Dynamics 365 Business Central is a comprehensive, cloud-based ERP solution that streamlines financial management, supply chain operations, and customer relationships.

It’s specifically designed for growing businesses looking for scalability, automation, and real-time insights.

Key Benefits of Paystand’s Integration with Dynamics 365 Business Central

Seamless ERP Integration

Paystand integrates directly with Dynamics 365 Business Central for a frictionless payment experience.

Automate Accounts Receivable

Say goodbye to manual invoicing, reconciliation, and payment tracking with smart automation features.

Eliminate Transaction Fees and Accelerate Cash Flow

Paystand eliminates percentage-based fees to help you cut costs as you grow, while faster payment processing and real-time transfers ensure your business gets paid more quickly.

Enhance Customer Experience

Give customers multiple payment options, including credit card, ACH, and bank payments, with a smooth, self-service checkout experience.

Improve Security & Compliance

End-to-end encryption and blockchain verification provide an extra layer of protection against fraud.

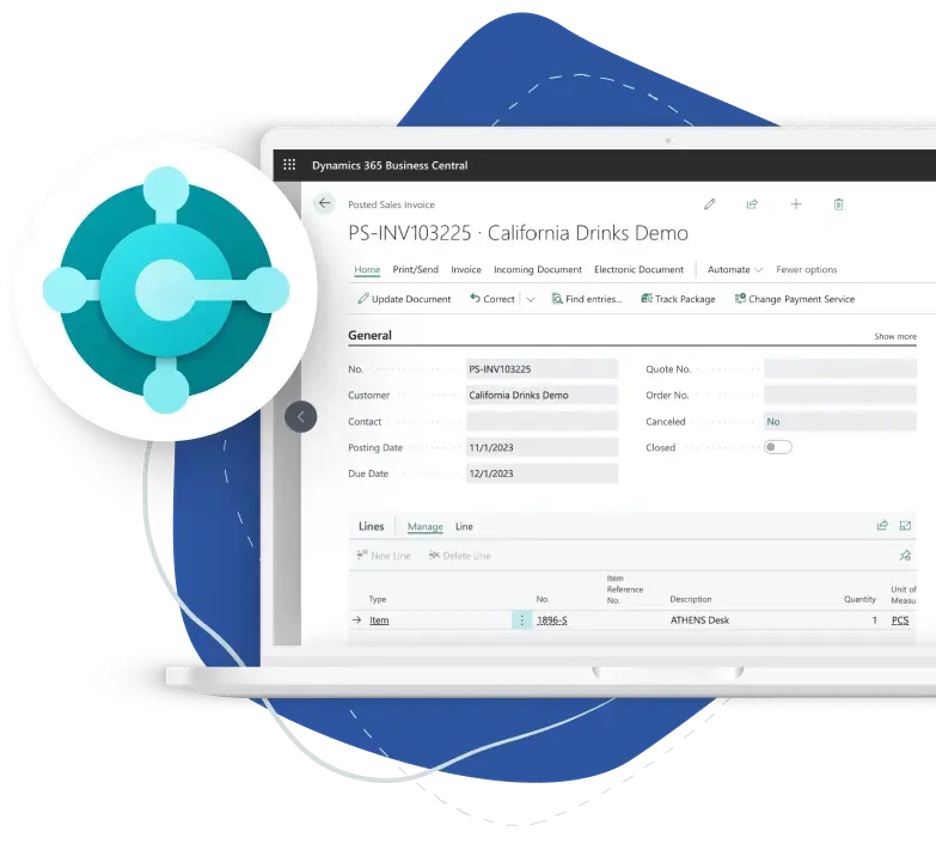

Enhance Dynamics 365 Payment Processing

Seamless Integration & Automated Workflows

Paystand’s direct integration with Microsoft Dynamics 365 Business Central enables businesses to automate the entire payment lifecycle, from invoicing to reconciliation.

Unlike traditional payment gateways that require manual intervention, Paystand leverages smart billing, automated reminders, and real-time transaction syncing to create a hands-off payment workflow.

Take your Microsoft Dynamics 365 Business Central experience to the next level with Paystand’s automated, zero-fee payment network. Reduce costs, improve efficiency, and gain greater control over your financial operations within your existing ERP.

Ready to transform your payments? Contact us today to learn more about integrating Paystand with Dynamics 365 Business Central.